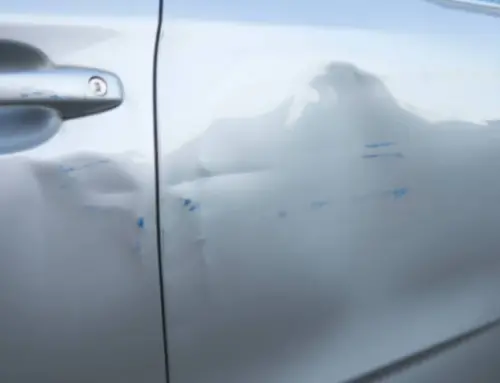

The majority of auto insurance claims, including those for dents, scratches, and door dings, are filed under the collision or comprehensive coverage categories. These protections are available as add-ons to your policy, and if you are concerned about the state of your vehicle, you should consider purchasing them seriously–like when you get a paintless dent repair near you.

Your vehicle is protected from damage that could be incurred in the event of a collision with another vehicle or object if you have auto collision coverage. Accidents involving a single car are also covered by collision insurance, such as when a vehicle collides with a guardrail or a curb.

For instance, collision coverage can pay for repairing those marks if you hit a mailbox or fence post with your car, causing scratches all the way down the side of your vehicle. If you file a claim under your collision policy, you will be liable for paying the associated deductible.

The unexpected damage not caused by a collision with another vehicle or item is covered under comprehensive car insurance. This type of damage might occur even if you are not driving the vehicle when it happens.

Acts of vandalism such as someone keying your car, hitting a deer, pet, or other wild animals, a tree branch falling on your vehicle, or a boulder smashing your glass are examples of the occurrences covered by auto insurance. When you file a claim for comprehensive coverage, you will also be responsible for paying a deductible.

Are There Any Blemishes Or Dents That Your Auto Insurance Would Not Cover?

There are several instances in which the insurance company will not pay for the cosmetic damage done to your vehicle, such as the following:

Normal wear and tear: auto insurance is intended to cover abrupt and unforeseen occurrences, not everyday wear and tear. It does not cover general wear and tear, which includes dents, scratches, door dings, and overall paint damage that may occur over time. Neither does it cover any other type of damage that may arise.

Time-lapse in filing a claim: The process of making a claim can take a significant amount of time, and many insurance providers have strict time limits that must be adhered to. Your insurer won’t cover a ding or damage caused some years ago.

Intentional damage: Auto insurance companies generally do not cover deliberate or malicious damage caused to your vehicle. For instance, if your car’s paint were intentionally scratched with a key, the insurance company would most likely not reimburse you for that.

Improper maintenance: If you properly maintain and care for your vehicle on a regular basis, it will be covered if it sustains any damages as a result. This includes keeping the oil the same regularly and other essential maintenance tasks.

Is It Worth Filing A Car Insurance Claim For A Dent Or Scratch?

It frequently is contingent on the total amount of damage. If the damage is relatively modest, paying for it out of your pocket can be more cost-effective.

Both collision and comprehensive coverage come with a deductible, but the amount varies from insurer to insurer and can be anywhere from $100 to $2,000. It is more cost-effective to pay for the damage out of pocket if the amount needed to fix it is less than your deductible.

On the other hand, if the damage is more severe and costly, it can make sense to register a claim for any paintless dents repair or scratches that need to be fixed. This is because filing a claim allows you to get reimbursed for the expense of repairing the damage.

For instance, if the comprehensive deductible on your insurance policy is $500 and your vehicle is vandalized with a key, resulting in $3,000 worth of damage, it would make perfect sense to submit a claim.

What Happens If Someone Dents Your Car?

If another driver was responsible for the superficial damage to your vehicle — for instance, if they dented your door with their door — the other driver’s auto insurance company might pay to have it repaired at your expense.

If you know who the other car’s driver is, you may request that they pay for the damages directly. If they refuse, you can file a claim with their insurance provider and have them cover it.

If you don’t know who caused the damage or if the responsible party doesn’t have auto insurance, you can file a claim with your insurance provider. It may cover the cost of repairing the damage if you have comprehensive coverage. Remember, however, that you will be responsible for paying the deductible.

It’s important to note that filing claims can result in higher premiums over time, so it’s best to weigh all options before proceeding with a claim. Getting an estimate from a body shop is always wise, as it can provide you with some insight before filing the claim.

What If I Damage Someone Else’s Car?

If you accidentally cause property damage to another person’s vehicle, ding their car door, or scratch another automobile. The property damage liability coverage included in your auto insurance policy may reimburse you for the cost of repairs up to the amount of your policy.

Vandalism is not covered by the liability provisions of most insurance plans, so if you purposefully cause damage to another person’s vehicle, you’ll have to pay for the repairs out of your own money. This includes cutting someone else’s tires or keying their vehicle with a key.

It’s important to remember that if you cause property damage to another person’s vehicle, the responsible party is not obligated to pay for the repairs out of their pocket. This means that if you don’t have enough money or auto insurance coverage to cover the cost of repairs, you may be held legally liable and need to pay for those costs through civil court proceedings.

In summary, car insurance companies generally do not cover intentional or malicious damage caused to your car. If the amount needed to a paintless dent repair or scratch is less than your deductible, it can make sense to pay for this yourself.

But if the damage is more severe and costly, it may be best to file a claim with your insurer or the other driver’s insurance provider. If you are the responsible party, your auto insurance policy may provide financial coverage for repairs to another person’s vehicle. In any case, checking with your insurer and getting an estimate from a body shop before filing a claim or paying out of pocket is essential.

Let Us Help You

Piedmont Dent Repair is here to help you repair damage caused by a dented car. Our team of skilled technicians can repair your vehicle quickly and efficiently, resulting in a beautiful finish that will make your vehicle look new.

To find out more about our dent repair services, don’t hesitate to get in touch with us today.